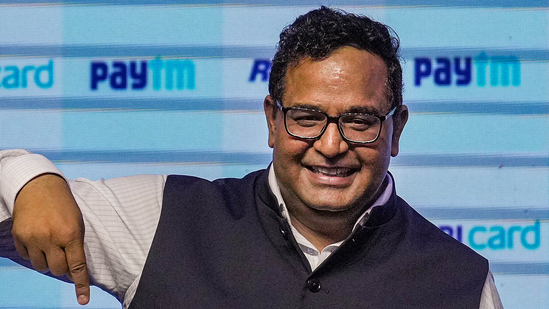

In a bizarre and humorous turn of events, Paytm founder and CEO Vijay Shekhar Sharma recently found himself at the center of a failed cyber fraud attempt. What made the incident unique was not just the scammer’s approach, but who they were pretending to be—Vijay Shekhar Sharma himself.

Taking to the social media platform X (formerly Twitter), Sharma shared screenshots of his WhatsApp conversation with the fraudster. He humorously titled the post “Impersonating myself to me,” which quickly went viral among netizens. The post not only showcased Sharma’s witty exchange but also brought attention to the growing threat of cyber impersonation and digital scams.

The Scammer’s Bold Attempt

In the WhatsApp chat, the scammer introduced himself as “Vijay Shekhar Sharma” and asked the real Sharma to save his “new number.” The impersonator then began probing for sensitive financial information related to the company. In a series of increasingly suspicious messages, the scammer:

- Asked about available company funds

- Demanded the contact number of the finance head

- Requested Sharma to forward a suspicious .exe file, disguised as a GST-related document

Despite the obvious red flags, Sharma chose to play along. He not only responded calmly but also trolled the scammer by suggesting a salary hike. His humorous take on the situation left followers amused and garnered widespread appreciation for handling the incident smartly and lightly.

Netizens React with Laughter and Caution

The screenshots of the chat drew a flood of reactions online. Many users praised Sharma’s calm demeanor and sense of humor, while others expressed concern about how scammers are getting bolder and more sophisticated. Some users even shared similar incidents they or their acquaintances had faced, highlighting the prevalence of such scams in today’s digital age.

The Darker Reality Behind the Laughs

While this incident ended on a funny note, it highlights a pressing issue—the rising sophistication of cyber frauds. Impersonation, phishing, and the use of malicious files are common tactics employed by fraudsters to gain unauthorized access to sensitive data, especially in corporate environments. Had this scammer targeted someone else within the company, the results could have been damaging.

Impersonating myself to me 🥸 pic.twitter.com/OtT63fKZU1

— Vijay Shekhar Sharma (@vijayshekhar) May 21, 2025

The episode serves as a wake-up call to both individuals and organizations to remain vigilant, educate employees, and ensure robust cybersecurity protocols are in place.

DoT Introduces ‘Financial Fraud Risk Indicator’ to Combat Cybercrime

Government Steps In Against Cyber Fraud

Amid growing concerns over rising cybercrime, the Department of Telecommunications (DoT) announced a major initiative to fight financial fraud in India. On Wednesday, the DoT introduced a powerful tool called the Financial Fraud Risk Indicator (FRI).

What is the FRI?

The Financial Fraud Risk Indicator is a feature integrated into the Digital Intelligence Platform (DIP). It is a multi-dimensional analytical tool designed to provide advanced, actionable intelligence to financial institutions. The tool helps detect and prevent cyber fraud by identifying mobile numbers that are potentially linked to fraudulent activities.

How Will It Help?

According to the DoT, the FRI tool aims to:

- Enhance intelligence sharing among banks, UPI service providers, and financial institutions

- Enable real-time validation checks during digital transactions

- Provide alerts when digital payments are being made to flagged mobile numbers

- Enable targeted and swift actions to prevent fraud before it happens

An official statement from the department read:

“FRI allows for swift, targeted, and collaborative action against suspected fraud in the telecom and financial domains.”

Collaboration is Key

The tool is expected to strengthen the ecosystem of financial security by allowing better collaboration between telecom operators and financial service providers. By flagging suspicious numbers in real time, institutions can block transactions and alert users before any financial damage occurs.

This development comes at a crucial time when digital transactions in India are at an all-time high, and fraudsters are constantly devising new ways to exploit technology.

Conclusion

The amusing exchange between Vijay Shekhar Sharma and his impersonator may have left many in splits, but it also serves as a stark reminder of the lurking dangers in the digital space. At the same time, the Department of Telecommunications’ initiative to launch the Financial Fraud Risk Indicator is a commendable step toward tackling cybercrime head-on.

Both stories highlight the need for digital awareness, cyber hygiene, and collaborative action to stay ahead of fraudsters in an increasingly connected world. Stay alert, double-check suspicious messages, and never share sensitive information without verifying the source—because the next scammer might just try to impersonate you to you.